While large corporate banks struggle to respond to changing customer expectations, bold new players enter the market, preying on the first opportunity to disrupt the financial world. Technology and intensive collaboration with customers seem to be at the heart of their relentless strategy.

What is a bank to you? Most likely, you once joined a bank to be able to pay and get paid. A bank guards over a figure of money that belongs to you. Maybe a bank has enabled you to purchase things you couldn’t afford yet.

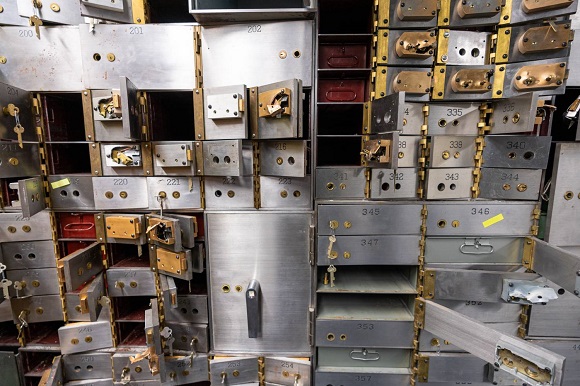

Overall, the banking industry offers a secure, trusted ledger and exchange network for monetary value and credit.

Every citizen of a developed country depends heavily on the intangible service that banks provide – a reality that is easily overlooked. I believe that the key role that banks play, deeply embedded in society, caused them to comfortably lean back when new opportunities and threats emerged with the evolution of the web.

Nearly every other industry tried to adapt and evolve to stay relevant in a highly competitive market with tech startups popping out the ground left and right. Brick and mortar stores went out of business while web shops tripled their revenue. Making money on entertainment – news, books, games, music, movies – changed drastically with on-demand and streaming services. Not to mention, taxi services that are faced with Uber, restaurants with Doordash, travel agencies with AirBnB, and so on. Every transaction made easier through the internet has been, is being and will be exploited.

Banks will be next to undergo a tech revolution – long overdue and inevitable.

So far, it seemed impossible for any forward-thinking entrepreneur to disrupt the banking industry by entering the market with a wild, new idea. In order to be in the banking business, you must be recognized and obtain a license. This comes with intimidating compliance issues, to avoid banks from collapsing and causing the next financial crisis.

The challenge posed by a heavily regulated banking industry, does not discourage so-called fintech startups to try to fight their way in. In fact, some of them are already succeeding.

As you are reading this, change is happening in the world of banking. This is where the topic of customer collaboration comes into play. Change is the quintessential ingredient for collaboration and offers a starting point for exciting conversation with (future) customers.

To old-school banks, big change is not a priority, to put it mildly. It is uncommon to bump into a bank that promotes public customer collaboration to improve products and services consistently. My guess would be that they simply don’t want to rock the boat and have clients to consciously consider their dated banking experience. Conservative banks rather operate inconspicuously. “Nothing to see here! Your money is in good hands!”

Fintech startups, on the other hand, seem to understand that innovation and customer collaboration pave the way to pinpoint and meet the evolving needs of people with a bank account.

Take Monzo for example, a newcomer in the UK banking industry. Monzo operates with a digital-first mindset and full transparency. Therefore, individual Monzo clients are encouraged to engage in a public community. Customer engagement takes place on the Community Forum for online discussion, on Making Monzo for online product collaboration and at Monzo Events for community members to meet face-to-face. The young bank also runs a Facebook group called the Monzo Saving Squad, where members share tips and tricks on how to manage your money.

Monzo’s rampant growth in the UK emboldened the company to prepare for entering the more fragmented US market in the near future. On a special website about the aspired transatlantic adventure, Monzo puts its proven formula of customer collaboration front and center: “Help us build the bank you want to use.” Not to mention their clever use of a public board on Trello.

Revolut, another rising star in the UK fintech scene, is taking a surprisingly similar route to Monzo’s. Just like Monzo, Revolut offers a sleek community and collaboration experience, and it is also storming the US market with products currently deep into beta. Back in 2017, the company set the stage for a heated confrontation: “Great news, Revolut is launching in the USA to clean up the American banking system.”

(In case you are interested: both Revolut’s and Monzo’s community websites run on Discourse, an open source forum solution.)

Many fintech startups are currently working on changing the finance business. Thanks to open banking, practically every company can claim a seat at the table now, without the need for a bank license. Open banking offers these startups a partnership with existing licensed banks to securely exchange financial data (API explained on YouTube). This solution enables a small team of app developers, for example, to launch a new mobile app in which the user can access his account details from any bank.

With data being more easily available through open banking, we can expect a surge of innovation that will profoundly shake the financial world. “Embracing disruption,” as accounting firm PwC aptly summarized the outlook for 2020 and beyond. The gap between the way business is done and the customer experience should finally close.

Have you come across a bank – old or new – that invests a lot in customer collaboration in response to shifting market circumstances? Let everyone know in the comments below, and make sure to add a link.